Debt consolidation is a financial solution that combines multiple bills into a single monthly payment at the lowest interest rate possible. This makes it easier to pay off debt because you only have one bill to worry about. It also helps you save money by minimizing interest charges. As a result, you are often able to get out of debt faster, even though you may pay less each month. The most popular way to consolidate is with a loan.

What is Debt Consolidation?

Debt consolidation helps you reduce the number of bills you have, as well as the amount of interest you would be paying. Debt consolidation is a good option if you have a lot of different bills and it’s getting difficult to keep up with the high-interest rates on all of them. It can be used for a variety of unsecured loans. Secured loans cannot be consolidated.

With debt consolidation, you will most likely be able to get out of debt faster, even with fewer monthly payments and/or lower interest rates. The most popular method of debt consolidation is by taking out a debt consolidation loan. A debt consolidation loan may be a good fit for you in certain circumstances. The first step is to understand your options, and then make an informed decision.

Learn more about what makes a consolidation loan unique »

How does Debt Consolidation work?

Debt consolidation is a solution to manage your debt. The goal is to reduce your number of bills and pay lower interest rates. The main appeal of debt consolidation is that it helps you get out of debt sooner while maintaining – or even improving – your credit score. There are a number of debt consolidation options. Below are descriptions of the most popular options. The one you use would depend on your specific circumstances.

Debt Consolidation Loan

The most common method of debt consolidation is by taking out a lower interest debt consolidation loan. Essentially, what you’re doing is taking out a lower interest loan to pay high interest debts. It is an unsecured personal loan that you can use to pay off all your existing debt. As it is an unsecured loan, you do not need to put up any collateral for the loan. You can qualify for one based on your credit score.

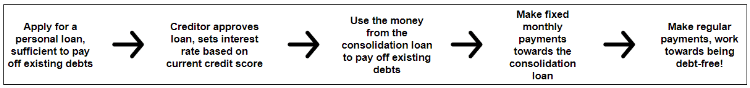

- Apply for a personal loan. The amount should be sufficient to pay off all your existing debts.

- A lender or creditor will then approve your loan application. They will set an interest rate based on your current credit score.

- The money you get from the consolidation loan is then used to pay off your existing debts.

- Now, you only have to make fixed monthly payments towards paying off the consolidation loan.

- Make regular timely payments, free up your budget, and work towards being debt-free!

Credit card balance transfer

A credit card balance transfer helps you consolidate existing debt into one payment, often at a lower interest rate. Balance transfer cards offer a lower rate of interest when you switch your account balances over.

These cards often have a 0% APR introductory rate on opening the account. The introductory APR is only for a limited duration. In most cases, this falls between 6 to 18 months. If you opt for this method, you can pay off the consolidated balance interest-free. To qualify for this, you need a good credit score, just like you would need for a consolidation loan.

This method is suitable if you have a lower amount of debt, ideally $5,000 or less. This will make it manageable for you to pay it off in full before the introductory 0% APR ends. If you’re not able to, high interest rates come back into effect once the introductory period ends.

Lines of Credit ( LOCs )

Another option – if you have good credit – is a Line of Credit, or an LOC. You can apply for a line of credit directly with your bank or local credit union. They will approve your application based on your credit score.

An LOC works like a credit card, in that they extend an open line of credit to you, up to a certain amount. Monthly payments only cover accrued interest, so payments will often be low.

However, if you only pay off the monthly charges, you are only paying back the interest, and not chipping away at your principal. To pay off a line of credit, you must make payments greater than the monthly charges. If this is not possible for you, an LOC might not be the best option.

Home equity borrowing options

A HELOC is a home equity line of credit. This is a secured form of credit. The lender will use your home equity as a guarantee that you will pay back the money. You can borrow more once you pay it back, i.e. it is revolving credit.

There are different ways to borrow against home equity, like second mortgages, HELOCs, and reverse mortgages. When you borrow against home equity, you can qualify for a lower rate of interest, even if you have a poor credit score. However, it also opens you up to more risk as your home is at stake. If you miss payments or are unable to keep up with your dues, you could end up having to deal with foreclosure.

It is generally not advised to use a secured form of credit to pay off unsecured debt. However, if you’re refinancing or have a HELOC and want to pay off relatively smaller higher interest debt, it may work well for you.

Debt management plans and credit counselling

With a debt management program, you can consolidate all your debt too. However, instead of taking on a consolidation loan, it instead sets up a consolidated repayment plan. This can be done through a credit counselling agency.

Generally, you only need to show a regular income in order to qualify. You will usually have a lower payment than what you owe individually on multiple bills. You don’t need to have a good credit score to qualify for this option, nor is there a minimum or maximum limit on your debt amounts.

The credit counselling agency can work with you to find a monthly payment that works best for your financial situation. The agency will work with your creditors to reduce – or even eliminate – interest charges that are applied to your balances. You can complete the entire plan in 60 payments or less.

With debt management, you pay back everything you owe. Therefore, it does not damage your credit score like a consumer proposal, bankruptcy, or debt settlement would. However, there would be a note on your credit report for two years that will show you paid your debts on an adjusted payment schedule. Overall, this is a good option if you are unable to qualify for a debt consolidation loan but still wish to pay back everything you owe and become debt-free.

Which consolidation option is right for you?

Advantages of Debt Consolidation

Debt consolidation has many advantages, both for your financial, as well as, your mental health. If you’re at a stage in your budget where you’re getting overwhelmed with multiple payments and high interest rates, debt consolidation may be a good option for you.

Simplify finances with a single monthly payment

If you’re struggling with multiple bills, debt consolidation will help streamline the process. It’s easy to miss a payment or end up with an overdraft, especially if you have to time them to paychecks. This also just keeps increasing the interest and fees that you will need to keep paying.

With consolidation, you will only have one payment to make monthly, and your finances will become much simpler to maintain. You also need to pay one creditor, as opposed to multiple lenders to communicate with. The stress relief alone brings more peace of mind.

Save time

While it reduces financial stress, it also reduces the time you need to spend maintaining all these different accounts. It frees up more time for you to spend the way you want, instead of managing multiple payments and speaking to multiple lenders.

Better for your credit score in the long term

In all debt consolidation solutions, you pay off all your debts in full. This reflects positively on your credit score. You will not have to juggle bills or deal with the repercussions of missed payments. You will need to keep up with the regular monthly payments. If you do, it will have an overall positive effect on your credit score.

Pay lower interest rates

Any consolidation strategy will often provide a much lower interest rate, compared to your current bills. This will reduce the amount of money you have to pay each month towards your debts as you will be charged less interest.

As your payments are likely to be a smaller amount than you were previously paying, you might be able to put down even more money when you can afford it. This would go towards the principal and help you pay off the debt even faster.

Reduced monthly payment amount

In most cases, debt consolidation will lead to a lower monthly payment. The duration of your loan (in case of a consolidation loan) or duration of introductory APR (in case of a credit card balance transfer) may also influence the payment amount, for example. If you sign up for a loan with a longer term, your monthly payments may go even lower.

Pay directly to creditors

You will be able to avoid payment pressures and collection calls. With all your debts paid in full, any calls you receive from them for payments will end. This greatly reduces financial stress.

Allows you to fix your budget

Having to make only one payment at a lower rate of interest will free up your budget. It will provide more room in your budget and you will not have to live paycheque to paycheque anymore. You can then start building an emergency fund with the money you freed up from going to high interest payments. This will help you cover your emergency expenses without having to depend on going into debt again.

Disadvantages of Debt Consolidation

While debt consolidation is a great solution for many, you need to understand whether it is right for you.

Not applicable or available to all

For a debt consolidation loan, you need to have a good credit history. If you have a good to excellent credit score, you may be able to qualify for an interest rate that is low enough to make this a beneficial option. You generally need at least 650 or higher to qualify. The higher your credit score, the lower the interest rate you will be offered. For that, your score should ideally be 720 or above.

Does consolidation work with bad credit?

Rates on personal loans can range from 5 percent up to 45 percent. If the rate on the loan is comparable to your credit card rates, you won’t get as much benefit. In general, this solution offers the most benefit when you can qualify for a rate of 10 percent or less on the loan.

Learn more about rates on consolidation »

If you don’t, other options like a credit card balance transfer would work if you have debt less than $3000. Another option that you can qualify for irrespective of credit score is debt management, but the adjusted payment schedule is noted on your credit report.

You need to figure out which one is best suited for you, as the availability of options depends on whether you fulfil their individual criteria.

Depends on how much you owe

This solution may not work the way you intend if you have a large amount of debt. If you’re looking for a debt consolidation loan to reduce the monthly payments you have, it depends on the loan term you sign up for. If you want a balance transfer, your amount should ideally be low.

Debt consolidation loan terms are usually between 12 to 60 months, so the longer the term, the lower your monthly payments. However, if you have high debt, even this singular monthly payment may be too high to manage.

For example, let’s say you owe more than $50,000. You have excellent credit (800+) so you qualify for a 5% APR. Even at the maximum term of 60 payments, your payments would be more than $900.

Will you qualify for debt consolidation?

For an LOC, if you pay the monthly charges, you are only paying back interest. To make headway toward the principal, you must make larger payments.

Not everyone may be able to afford the consolidated monthly payment

In the previous example, the high monthly loan payment or the extra LOC payment might not be possible for many. It’s important to pay attention to the actual interest amount that you’ll have to pay. While uncommon, it is possible that if the loan term is longer, you may end up paying more over the course of the duration, even though the monthly payments are a smaller sum.

In that case, a debt consolidation loan would not help fix your budget or your balances. You must check and ensure that you are able to afford monthly payments on the solution you choose before you go ahead with a specific choice.

Risk of greater debt

Once you use a consolidation loan – or other debt solution – to pay off your balances, your credit cards or line of credit will not be closed. This means that the accounts still remain open for your use. If you start running up balances on the cards again, you will have to start making payments again. If you get into debt again before your consolidation loan is paid off, you will end up paying even more in total.

You need to have a strong budget and allocate money accordingly. If you must use your cards again, make sure you only spend as much as you are able to pay off in full every month. Your budget should have space for the monthly loan payments and other living expenses so that you can avoid credit card debt stacking up again.

Variable terms

The loan terms can vary from 12 to 60 months from most lenders. Credit card introductory rates vary from 6 to 18 months.

Depending again on how much you owe in total, the term you need will differ. The lowest available is 12 months, so if you feel you can pay back your debts by yourself before that period, it might not make sense to opt for a debt consolidation loan. You might find that a balance transfer might be better.

On the other hand, if you owe high amounts of debt, even 60 months may be too little. Especially if you need a quick resolution, debt consolidation might not be the right fit. In such cases, you may want to look into filing for a consumer proposal or bankruptcy. However, these options are likely to damage your credit.

Is Debt Consolidation right for you?

Once you know what the advantages and disadvantages of debt consolidation are, you can see whether it fits your situation and finances.

If you decide to go ahead with this solution, you need to decide which option you pick, be it a consolidation loan, credit card balance transfer, or something else. Irrespective, you need to choose something that works for your specific situation. You will need to check what your monthly payment might potentially be. See if you’d be able to make those payments without straining your budget. You don’t want to opt for a solution that would make it even harder for you to get by. You also don’t want to end up with a high monthly payment due to having a very large amount of debt.

If you’re considering debt consolidation in Canada, reach out to us for a consultation. We’d be happy to help you figure out whether it’s a good fit for you.

When is Debt Consolidation a Good Idea?

- If you are able to manage payments and have been making them on time, but keeping up with the bills has become overwhelming.

- If you have good credit and are able to qualify for a new loan with a lower interest rate.

- If you think you can afford to make the new monthly payments and can fit it into your existing budget.

If you said yes to these three things, debt consolidation might be a good option for you to consider. This may give you the ability to pay off your debts faster and reduce the total amount of debt you owe.

You will likely be able to qualify for a better interest rate, which will help you pay off your principal faster, even if you’re paying the same total amount every month. In most cases, you will end up with lower monthly payments.

A debt consolidation loan will also help you switch over to a fixed interest rate, in case you are currently handling high variable interest rates.

When is Debt Consolidation a Bad Idea?

- If you have poor credit scores and are unlikely to qualify for a lower-interest-rate loan.

- If your debt is relatively small and you would be able to manage regular payments and pay it off soon.

- If the new monthly payment is higher than your current bills.

- If you need a quick solution or are in debt which would be unaffordable even with a debt consolidation. You might want to consider a consumer proposal or other debt-relief options in that case.

What Types of Debt Can You Consolidate?

Most unsecured debts can be paid off by using a consolidation loan. Some examples are:

- Credit cards

- Retail store cards

- Gas cards

- Unsecured personal loans, including other consolidation loans

- Unsecured lines of credit (LOCs)

- Public utility debts

- Child support arrears

- Tax debt

A secured loan that has collateral cannot be consolidated. For example, if you have a mortgage or auto loan, it cannot qualify for inclusion in a debt consolidation.

Debt Consolidation’s Effects on Your Credit

When you apply for a debt consolidation loan, you may see a temporary drop in your credit score. This is due to a hard inquiry on your credit report. This happens whenever you apply for credit with any lender. This will only affect your credit score by a few points and will rebound off your score in a few months. In fact, if you already have a good credit history, the effect will be even less.

You can also avoid credit damage from missed payments across multiple bills, as they will be paid off fully after a debt consolidation loan.

Overall, it also reflects positively on your credit report as all your other debts will be paid in full and only one open loan will remain on your credit report and affect the score.

What is the best way to Consolidate Debt?

As we’ve seen, there are many different solutions to consolidate your debt. The goal is to pay lower interest rates and reduce multiple bills into a single fixed monthly payment. You need to find the solution that is the right fit for you depending on your specific situation. For example, if you have less than $5,000 in debt, you may want to consider a credit card balance transfer. If your credit score isn’t good enough to qualify for debt consolidation, you may want to look into debt management. However, the most common way to consolidate debt is by applying for a debt consolidation loan. That’s why, in this section, we will focus solely on debt consolidation loans.

How can you get a Debt Consolidation Loan?

To be eligible for a debt consolidation score, you will need to have a good credit score. Your credit score must be 650 at minimum. If you have an excellent credit score of 720 or higher, you may qualify for a lower APR. This means you may be approved for a lower interest rate, and you can save a lot on interest payments.

If you have good credit and are able to make payments, a consolidation loan is likely to be your best bet. This is especially true if you have a good credit score and would like to maintain it.

A good credit score makes you eligible for lower interest rates, and a consolidation loan won’t affect your credit score much. It is certainly better for your credit score than other debt solutions.

If debt consolidation works for your situation, a consolidation loan is a viable option worth considering.

- You apply for a personal loan in an amount that will pay off all the existing debts you wish to pay off.

- The lender will approve you for the loan and set its interest rate based on your credit score.

- The money from the loan gets used to pay off your existing debts.

- This leaves only the consolidation loan to repay, giving you one fixed monthly payment.

More details about the process »

Who should you speak to about consolidating your debt?

You can find out more about debt consolidation by speaking to your financial institution, existing creditors or personal loan companies. Financial advisors and coaches are also a good option, but do your homework and pick trustworthy sources of information.

If you’re unsure of whether it’s the right fit and you’re considering other options, who you speak to depends on which option you pick. For example, if you opt for debt management, a Credit Counselling Agency would be able to help you with financial advice and help you come up with a debt management plan.

While all these sources would also be able to recommend a good debt solution, the choice is always yours. They can support you with the right information and resources. If you’d like to know more, take a look through our resources for more information.

Debt Consolidation Repayment Plan and Process

Once you’ve taken on a debt consolidation solution, you need to set up a repayment plan. Take advantage of the consolidation and use it to streamline your overall finances. This way, your finances will be in a very healthy state by the time you’ve paid off your dues.

Make a budget

This would be a great time to put together a budget. With your consolidation process simplifying your various debts into one payment and one line item, it gets much easier to keep track of. You would also be able to get an overall view of your cash flow. This will help you understand if you can cut back in some areas, or if your money would be better spent elsewhere. It might also help you understand how you can start saving and building an emergency fund.

Pay down debt faster

Having a budget in place will give you an overview of your finances. If you find that you are able to save some money, the first thing you should do is build an emergency fund so you will not have to be dependent on credit again. Once you have that in place, you might find that you are able to put more money towards your payments. If you are able to do so, you can pay off your debt even faster by periodically making larger or more frequent payments when possible.

Do not add new debt and use credit cards wisely

Once you’re approved for a consolidation solution, do not continue to add new debts to your credit cards. If you must use your credit card, make sure you pay it off in full every month. Any new debts afterwards would be considered separate from what you’ve already consolidated. If you’re unable to keep up with your new payments, you may end up carrying even more debt.

If you find yourself in a situation where you must use credit cards, pay it off in full every month before the due date.

Warning: Debt settlement is not consolidation!

Debt consolidation is not the same as debt settlement.

With a consolidation solution, you pay back everything you owe, generally with a lower interest rate. You would be paying the full principal amount – everything you borrowed. With debt settlement, you only pay back a part of the principal, and not the full amount. Due to this, it has a greater negative effect on your credit compared to consolidation. The effects on your credit report can last for six years.

Some companies may try to mislead customers – they think they’re signing up for consolidation but instead they’re signing up for debt settlement. If you’re looking to get professional advice on your debt situation, do your research on the company as well as the solution you’re considering. Check everything out before you sign anything or make payments.

Key Takeaways

Debt consolidation is a way to convert multiple bills into one monthly payment. You would be borrowing money at a lower interest rate in order to pay off all your higher interest loans. Most types of unsecured debt can be paid off by a consolidation solution.

Debt consolidation may be the right for you if you are able to manage payments, have good credit, and can fit the new payments within your budget.

Debt consolidation can help you simplify your finances, save time, and budget better. It also has an overall positive effect on your credit score in the long term. You would have lower interest rates as well as a lower monthly payment.

The most common method of approaching debt consolidation is by taking on a debt consolidation loan. This is an unsecured personal loan, To qualify, your credit score must be 650 at minimum.

Apart from a debt consolidation loan, there are other ways to consolidate your debts, like credit card balance transfers, LOCs, HELOCs, debt management plans, and credit counselling. With these, you are still able to pay off your debt in full. These may be worth considering as well.

If you do opt for a consolidation solution, remember that you need to create your budget and stick to it. Do not default on payments, and start keeping track of your cash flow. It’s also important to start building an emergency fund.

Speak to a trustee or credit counselling agency in order to make a more informed decision. Once they understand your financial situation, they can help you understand whether debt consolidation is right for you. <a href=”https://www.debt.ca/debt-relief”>Contact us today

Frequently Asked Questions about Debt Consolidation

If you are able to afford your monthly payments, pay your bills on time, and have a steady income and good credit score, you are likely to be able to qualify for a debt consolidation loan. Based on these parameters, you will often qualify for lower interest rates, which will help you pay off the principal faster.

No, debt consolidation is not the same as debt settlement.

With consolidation, you pay back everything you owe, just at a lower interest rate. You can only qualify for consolidation if you already have good credit.

With debt settlement, you only pay back a portion of your total borrowing. Due to this, it has a relatively harsher effect on your credit, which can last up to 6 years.

While not very likely, it is still possible to get a debt consolidation loan with bad credit. Even if you do manage to qualify, you will be offered a relatively higher interest rate. It is often recommended to take a few months to try and improve your credit score before applying for a debt consolidation loan. It will likely get you better interest rates and make it easier for you to qualify.

Credit scores do drop right at the beginning of debt consolidation. Credit applications require a hard credit check which means a credit drop of less than 5 points and only stays on your credit score for a few months.

Debt consolidation can be a good fit if you have multiple debts and want to simplify your finances. If you’re in a position where you are already able to manage timely payments and have a good credit score, debt consolidation helps you bring down the interest rate you’re paying, improving your budget and freeing up more cash for other needs, for example, building an emergency fund.