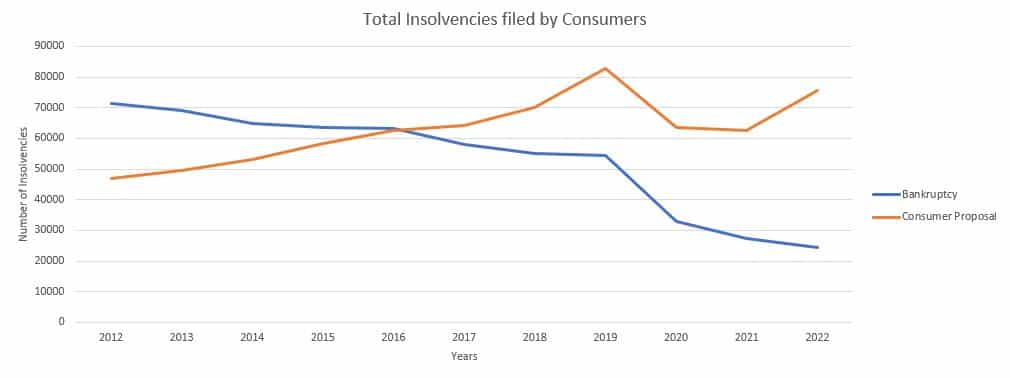

Consumer behaviour has shifted in the past decade toward more consumer proposals. As Canadians cope with financial crises, more people settle with creditors for less than they owe.

Canadian consumers have two choices when faced with insolvency. Until lately, bankruptcy has been the preferred route. Over the past decade, the demand for consumer proposals has risen. The number of personal bankruptcies continues to fall. Bankruptcies now account for less than 25% of insolvencies, down from 40% just 4 years ago.

The Canadian government reports a drop of over 10% in bankruptcies and an increase of about 20% in proposals in 2022 compared to 2021. Looking further back, this trend is not new.

Top Reasons for financial difficulty

Almost three-quarters of Canadians report that they face insolvency due to “financial mismanagement.” This vague description gives insight into why credit counselling is so vital.

The Office of the Superintendent of Bankruptcy keeps the statistics on why debtors file. Beyond financial mismanagement, this is what filers say about their situations.

- Almost half (48%) reported a loss of income as a top reason for money trouble.

- 21% have medical reasons that contribute to financial woes.

- 16% recently blamed the COVID-19 Pandemic.

- 12% faced a breakdown in a relationship.

No matter the reason, when in financial difficulty, consumers seek solid answers.

What is a consumer proposal?

Consumer proposals are a legally binding process administered through a Licensed Insolvency Trustee. Canadians seeking debt relief make a proposal to their creditors through a trustee.

The group of creditors vote to accept or reject the proposal. The vote is weighted based on the amount owed to each creditor. If accepted, debtors pay back only some of the total balance due.

Upon acceptance of a consumer proposal

Upon acceptance, the debtor:

- Pays a lump sum or makes payments to the Licensed Insolvency Trustee. The trustee passes the payments along to creditors

- Keeps their assets as long as they make payments

- Attends two financial counselling sessions

- Follows any other conditions outlined

When a consumer proposal is not accepted

If not accepted, the debtor can:

- Resubmit with changes

- Seek other options

- Declare bankruptcy

Proposal conditions met?

Once the conditions of the consumer proposal are fully met, the debtor is legally released from debts in the proposal.

The proposal is void if the debtor misses three monthly payments or if any payment is more than three months past due. Creditors can again collect the funds, except in special situations. A void consumer proposal may sometimes be revived.

Benefits of a consumer proposal

The decision about how to manage insolvency is highly personal and unique to each situation.

- Compared to bankruptcy, those facing insolvency keep more assets after a consumer proposal.

- The proposal affects the debtor’s credit rating for three years after the end of the terms of the agreement. A first bankruptcy affects a credit score for seven years. A second bankruptcy stays on the credit report as long as 14 years. So, consumer proposals are a natural choice for anyone who has declared bankruptcy before.

- Entrepreneurs regularly choose a consumer proposal to allow the option to remain a business director. A bankruptcy does not allow that option.

Logistics aside, a big reason is purely psychological. Bankruptcy packs a huge emotional punch that Canadians simply prefer to avoid.

How consumer proposals affect credit scores

A debtor’s credit score takes a big hit after declaring bankruptcy or submitting a consumer proposal.

Information on a credit report is removed after a specific timeframe. The period depends on the province and the kind of information. The duration of the proposal’s term also varies by province, with the information affecting the credit score for a few years afterward.

Lenders are not required to offer anyone credit. So many Canadians find their ability to obtain and use credit quite limited.

After fulfilling the terms of a consumer proposal, debtors receive a “certificate of full performance.” Experts recommend sending a copy to the major credit-reporting agencies. This ensures the credit record is updated. Consumers should also keep all proposal-related documents in case future lenders request them.

Regulatory change in 2009

In 2009, regulations increased the maximum debt limit in a consumer proposal. The change from $75,000 to $250,000 made it easier for those with larger debts to avoid bankruptcy. As a result, there was a significant increase in consumer proposals. All by individuals who would not previously have been eligible. Most of the rise in filers after 2009 had debts between $75,000 and $150,000.

Lately, inflation has been squeezing household budgets and depleting Canadian savings accounts. Plus, rents have significantly increased. Eighty-four percent of insolvency applications are from non-homeownwers. Credit card balances led to higher debt servicing costs. This undermined consumers’ financial stability nationwide.

Consumer proposals based on optimism

As a consumer faces insolvency, the bankruptcy route may be uphill, but it does move fairly swiftly. Emotionally traumatizing, perhaps, but may be a logical choice.

With a consumer proposal, payments may drag on for up to five years. Monthly reminders continue. Also, creditors do tend to look more favourably at the fact that you made the effort to pay some of the debt back over none. That’s why many Canadians are more likely to choose a consumer proposal when optimistic about their financial future.

By accepting a minimum payment, debtors look forward to having more money to pay off the proposal early. In a bankruptcy, if the debtor’s situation improves, they must pay extra. A sudden windfall, an inheritance, a big tax return, winning the lottery, or a better job – all would cost more in a bankruptcy.

The inability to keep assets and the negative emotional impact of bankruptcy seem to steer those in Canada away from that option. Instead, consumers are leaning more heavily toward consumer proposals.

Overall, hope drives Canadians toward consumer proposals. They look to the future and believe circumstances will improve.

If you face financial uncertainty, contact us today. Using a debt relief plan created by one of our experts early on may help you avoid filing for either a consumer proposal or bankruptcy.