Soft saving is a new personal finance trend that’s been growing quickly and gaining popularity. It is about prioritizing your present quality of life, and not saving aggressively for the future. Like many recent financial trends, this too found traction online on social media, first adopted and spread by Gen Z.

What is soft saving?

With the soft saving strategy, the focus is on your present lifestyle and how you can improve your existing quality of life. Maintaining a lifestyle that serves you is more appealing than saving up for long-term security. Consequently, there is less of an emphasis on budgeting, saving or investing. This is not to say that people following this trend don’t save at all, just that it’s not aggressive or retirement-oriented. Building savings is a low-pressure activity, and for many, the goal is to have a basic safety net or emergency fund in place.

Beyond that, the main focus is on creating a good lifestyle in the present, in terms of quality of life, mental health and wellness. With soft saving, it is in fact encouraged to spend more on experiences and choices that can improve their present circumstances.

The good side

Quality of life improvement

Following soft saving instead of a more saving-oriented money management style can lead to spending on quality-of-life upgrades and improvements. This not only elevates your day-to-day life but can also support better mental health. People deserve to enjoy their life, even when inflation and cost of living expenses are on the rise. Soft saving allows you to spend on experiences and things that will make a difference to you.

Prioritize better work-life balance

When you are willing to adjust your lifestyle and spending patterns, other opportunities show up that may not have been previously feasible. If having a good work-life balance is a priority for you, soft savings will allow you to choose a less stressful job. While it may not have the higher paycheque of a high-stress job, a more flexible one will add value to your life in many ways apart from money.

Time to pursue hobbies and interests

With a better work-life balance and a more forgiving approach to savings, you could have more time and energy to devote to the things you want to spend time on. This means more time for hobbies, passions, and other interests outside of work. Having a well-rounded life is more than paycheques and money in the bank, and the soft saving trend brings this into focus.

Flexible approach to spending

Soft saving provides a relatively flexible approach to spending, especially when compared to other budgeting and saving-oriented strategies and trends. This flexibility makes it easier to accommodate life changes without straining your budget. It may mean modifying your spending based on what your needs are at the moment, or using that emergency fund for an unexpected expense. In fact, that’s what soft saving is all about – making sure your money is able to serve and support you when you need it.

Helps tackle lifestyle inflation

A big plus for soft saving is that it encourages living within your means. Yes, it does include spending on quality-of-life upgrades, which is better for your pocket than making purchases that may not add any real value to your life. After that, you can save the rest! In that way, soft saving can help you stay away from lifestyle inflation and spending creep.

The bad side

Less long-term savings and investments

When the focus is on quality of life in the present, over saving for the future, there will naturally be more expenses in the present. This means that overall, you may have less long-term savings and investment. Soft savings may help make the present more enjoyable, but remember that it also means you will likely have less in the future, compared to someone who would be saving more aggressively.

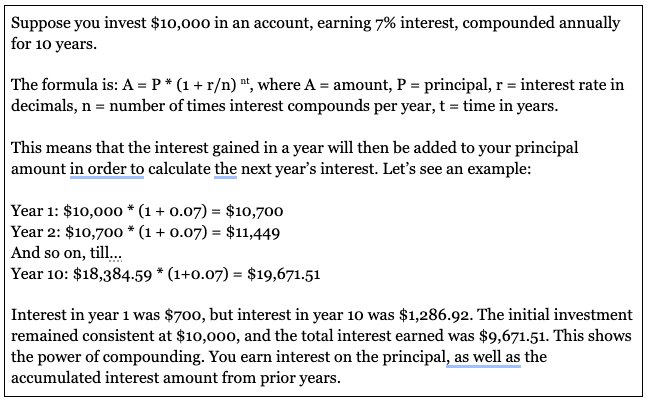

Less compound interest

Compound interest works over a long period of time to build your savings and investments further. The more you save, and the longer you leave those savings untouched, the more interest it will gain over time. That’s why you will also see lesser interest gains over time with less savings. If you want to follow the soft savings trend, this is a tradeoff you would have to be willing to make. To get a clear picture of the impact of savings, see the example below.

Possible financial vulnerability

If you don’t have a sufficient safety net or emergency fund, you might be vulnerable to financial changes. If these incidents are sudden or unexpected, it could be even more of a hit and could lead to debt. That’s why we recommend saving up an emergency fund and making your RRSP and TFSA contributions, at the minimum. Soft saving does include saving, after all!

Not a long-term approach

Soft saving has gained a lot of traction as a new financial trend, but trends are often short-lived by definition. If soft saving is treated like a long-term approach to your finances, it may lead to regret once older. Following soft saving long term could lead to not saving sufficiently over the years, as a whole.

Why is it taking off now?

Economic challenges

With inflation that has been rising for a long time and an increasingly difficult and competitive job market, many more people are facing economic challenges. Student loan debt is on the rise, and not everyone can get high-paying jobs to help clear their debt. Faced with such financial problems, a trend that encourages supporting yourself and spending to upgrade your present quality of life quickly gained favour.

Changing work structure

Jobs today no longer offer stable, decades-long positions that were a dependable source of income, like previous generations experienced. The nature of work has become more flexible in general as well. It is now increasingly acceptable to take breaks, develop new skills, and work on yourself personally and professionally. Having that flexibility also allows people to see if this method of money management can serve them well.

Changing generational priorities

Gen Z is already dealing with a lot of economic and work-related changes at a young age, and their priorities have also shifted accordingly. There is a greater emphasis on emotional and mental well-being, work-life balance, and financial wellness. This shift started with Gen Z, making for a very interesting contrast to the “hustle culture” and “girl boss” era adopted and favoured by millennials.

Greater financial literacy

In our present day, all sorts of information and resources are widely available and easily accessible. Due to this, a lot of people are able to learn and understand topics that may have previously had a barrier to learning. One of these is financial literacy, especially in terms of understanding personal financial concepts. Many more people now, with Gen Z taking the lead, are better equipped to understand money management. They’re learning how to budget, and the importance of maintaining emergency funds.

Tips on implementing soft saving

If soft saving resonates with you and you want to try it out, here are a few tips:

- Focus on what you can do to make your life better at present. If you know a little extra expense can improve your daily life, it may be worth the cost of purchase.

- Spend on things that support your emotional and mental wellness. This does not mean you necessarily have to spend more – if you realize you can spend less to attain your goals, that is a great outcome too! If this seems more in tune with your preferences, look into a no-spend month or week.

- If you find that you prioritize a better work-life balance, you could even switch to a less stressful job. Soft saving allows you to explore what serves you today, and not only in the future.

- With better control over your time, you would be free to pursue hobbies and passion projects outside of work. Spend time on things that help you feel fulfilled.

- You still need to save, so try and build an emergency fund. While $500 would be a good start too, it would be ideal to have an emergency fund that can cover 3-6 months of living expenses.

Key takeaways

Soft saving is a financial trend that first found popularity online with Gen Z. It involves focusing on improving your quality of life and giving greater importance to your mental and emotional wellness. Better work-life balance and more time to spend on your own interests is a big part of the appeal of this trend.

You still need to save some money, so build up an emergency fund or basic safety net. This doesn’t mean not to save, but rather not having to save aggressively for retirement at the cost of your present life. However, this also means you will have relatively less savings in retirement. This is why soft saving may not be a good long-term financial strategy, but it can be beneficial in the short term.

Soft saving, like “girl math” and many other financial trends, provides the benefit of fostering discussions around money management. With the current economic atmosphere, it’s no surprise that soft saving has found an audience. Remember to still spend within your means, as you don’t want to be in debt because of this. If you’re currently dealing with debt, you can contact one of our trained credit counsellors for advice – they can help you figure out which debt relief strategy could be the right fit for your specific situation.