Financial literacy is becoming more important to understand and maintain your finances. It undoubtedly helps manage finances on a personal scale, and also allows you to navigate the greater financial landscape. Globally, financial literacy is crucial for economic well-being and stability. This is true for individuals as well as the greater community, and indeed, entire countries.

Financial Literacy Month

November is Financial Literacy Month in Canada, emphasizing the importance of financial education. 2024 is the 14th edition of this program, led by the Financial Consumer Agency of Canada (FCAC).

Financial systems and processes are becoming increasingly complex on a global scale,. There is a growing need for financial education as well. People may not be aware of the tools and resources available to them, or even what guidance they could have access to.

The theme for this year’s Financial Literacy campaign is “Money on your Mind. Talk about it!” It encourages talking about money, which is still taboo for many Canadians. It can be difficult, especially if the financial matters may be negative or embarrassing. In reality, it’s kind of the opposite. Research shows that talking about money can build financial confidence and can lead to better financial outcomes. It reminds us of the loud budgeting trend, don’t you think?

Key learnings

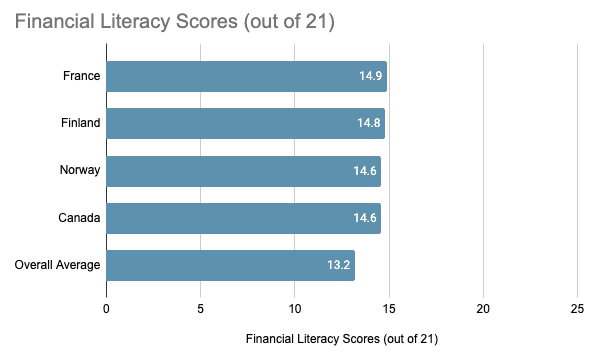

All data points used below are taken from OECD/INFE surveys, including the OECD/INFE 2023 International Survey of Adult Financial Literacy and the OECD/INFE 2016 International Survey of Adult Financial Literacy Competencies.

Note that the 2023 report does not include Canada in its survey coverage, however, it covers 39 countries including 20 OECD member countries and 8 G20 members. The 2016 survey covers 30 countries and economies, including 17 OECD countries, and does include Canada in its research and findings.

Financial knowledge

Sixty-three percent of adults in the 2023 survey were able to answer financial questions correctly. In the 2016 survey, the average score for financial literacy for all participating countries was 13.2 out of a possible 21. Canada was 4th in terms of the highest global average at 14.6, behind France (14.9), Finland (14.8), and Norway (14.6). This was calculated on the basis of financial knowledge, attitudes, and behaviour.

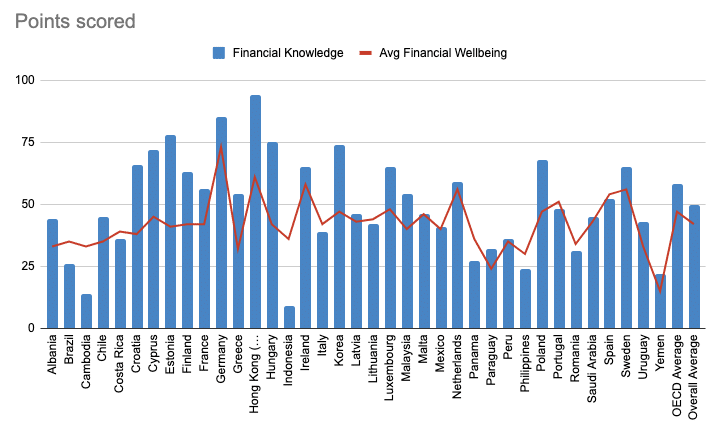

The 2023 OECD survey also found a stark gender gap: men scored higher than women in terms of financial knowledge. High-income countries scored better in financial literacy than low and middle-income countries. Emerging economies are better in some specific areas of financial literacy, but not in all areas like high-income countries.

This shows that as a country’s wealth increases, the financial literacy of its citizens also starts to trend upwards. It may reflect in different areas of learning, development, and accessing the right resources and tools.

Financial well-being

The OECD 2023 average financial well-being score was 47 out of 100 points, which is less than half. Higher-income countries once again scored higher than the average, with countries like Germany at 73 points, and Hong Kong at 61.

In terms of financial resilience, less than half of the 2023 respondents said they had a budget, or that they could cover living expenses for at least three months without a main source of income. They also showed a lack of confidence in financial decision-making. The score for financial resilience across 2023’s participating countries came out to 46 out of 100.

Overall, the global outlook in terms of financial well-being is relatively muted, with only 38% of adults reporting having money left over at the end of the month.

Financial priorities

Many survey respondents showed an interest in improving their financial health. People have goals like paying off debt faster, saving more (49% in the 2023 survey), building an emergency fund (31% in the 2023 survey), and contributing to their retirement savings.

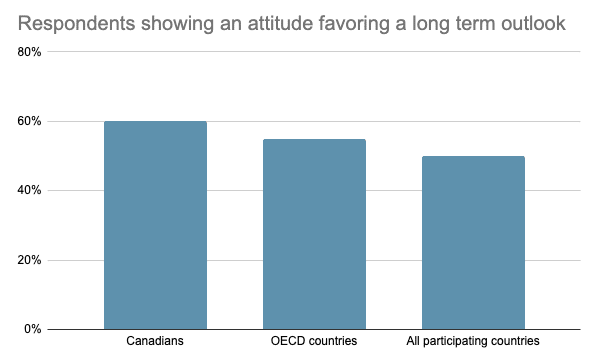

This shows a higher awareness of the importance of financial stability. However, surveys show that more adults prioritized short-term financial goals instead of long-term planning. The 2016 survey showed that more than 60% of Canadian respondents showed an attitude that favours the long term, compared to 55% across OECD countries, and 50% across all participating countries and economies.

Move towards digital

In our digital age, there is naturally an increase in people using digital platforms to apply for credit, check credit scores, and access banking information. This shows that digital financial literacy is also important.

The 2023 survey shows that such services are growing, but adults lack confidence in usage. This seems to imply that there is a gap between what is available on the market and what kind of information people are actually looking for.

For people to build confidence in their digital financial literacy skills, they need to be able to access easily understandable information, presented in a way that can help them implement things the right way. An important aspect of this is the neutrality of the information source – unfortunately, companies and service providers with ulterior motives may be less likely to be neutral or provide complete information, unless legally required to do so.

People need neutral, trustworthy sources of relevant and helpful information.

Generational changes

Gen Z and Millenials are more likely to apply for credit and use digital platforms. Since they can be considered digital natives, it is a good way to provide – and access – financial information for them. The 2023 survey also shows a notable divide in digital financial literacy between generations.

This shows that there is a need for different modes of providing this financial education for different age groups/generations. By reaching people where they are more likely to spend their time, you can more easily provide relevant financial information and access, whether digitally or otherwise.

Implications

There is a clear need for targeted financial literacy programs to target different generations and demographics. It may also be feasible to address age-specific concerns more appropriately, if any.

There is also a continued need for personal finance education globally, and neutral, relevant resources can be very beneficial. Ideally, there could also be targeted programs to help bridge the gender divide in terms of literacy.

This financial education should also emphasize long-term planning over short-term planning. Depending on where people currently stand in terms of their knowledge of financial management, there can also be resources that teach how to manage money or create a budget. Wherever people are in terms of their money management skills, there is scope to learn, improve, be debt free and be in control of their finances.